Table of Contents

"Why is crypto crashing again?" is a question you often ask yourself if you monitor the cryptocurrency market. After all, Cryptocurrencies constantly seem to be moving on an insane and unexpected path. Cryptocurrencies are more open to sharp price fluctuations because they are still relatively new and have less regulation.

Cryptocurrency markets frequently experience ups and downs. The primary cause of the industry's ongoing price drops is market volatility, which is also typically the quick, simple answer to the reason of crypto market crash. Cryptocurrencies' basic instability originates from the fact that, unlike traditional financial markets, they are not controlled by a single body.

Let's examine the present situation of the Bitcoin market and the causes of the crypto crash today.

Crash of Crypto Again

The market crashed once more at the beginning of August despite the industry's recovery of these coins. It appears that the bad luck in the cryptocurrency space is endless. The largest losers among cryptocurrencies are the top 10, with a total loss of $300 billion. Some of these coins are Ethereum, Solana, Bitcoin, and more.

The recent stock market crash, which caused extreme instability in a market that was meant to be expanding, is the reason for crypto drop incident. It has an impact on the whole sector. For example, Bitcoin, which had recently jumped to as high as $70,000, crashed below $60,000 and is currently showing extreme reds on the charts.

The FBI has alerted investors on the need to protect their accounts since hackers might use this as a chance to rob from wallets.

Why Cryptocurrency Crash Today?

1. Technological Issues

Blockchain is one of the core technologies that power cryptocurrencies; in short, it's a decentralized record that keeps track of every transaction. The blockchain's ability to process transactions may be stressed as more people and companies use cryptocurrency. Higher fees and longer processing periods may result from this.

Another significant technological aspect affecting the value of cryptocurrencies is their security. Investors may decide to sell off their holdings due to concerns about the security of their digital assets, which would lower prices and cause any crypto crisis.

2. Regular Challenges

The digital character of cryptocurrencies enables crypto markets different from the perspective of global financial regulators and governments. The absence of a single, worldwide regulatory framework has resulted in a complex web of laws and regulations. This legal confusion could possibly be the reason why the cryptocurrency market is crashing.

Investors may become uneasy due to the unknowns about regulatory changes. Sharp price drops might result from government announcements of new laws or rapid changes in policy towards cryptocurrencies.

3. Market Emotion and Rumor

Cryptocurrencies are unusual in that they primarily depend on the opinions of their users. Their prices move to the beat of public emotion in addition to just following a supply and demand pattern. Panic happens during a declining market trend. People begin to sell because they think they will lose even more. This anxiety feeds a downward spiral in prices that keeps repeating.

Investors need to be careful and avoid making quick judgments. For anyone expecting to survive the wild ride of price fluctuations, they must know the emotional aspects of the cryptocurrency market.

4. Economic Impacts

External economic factors can significantly influence the direction of prices. These elements affect investors' choices, the mood of the market, and the bitcoin market itself. Cryptocurrency prices can respond differently to instability in traditional financial markets, such as a downturn or a significant economic crisis.

Knowing how outside economic factors may impact the cryptocurrency market is crucial for traders and investors because it enables them to predict and adjust to price changes resulting from events occurring outside of the Bitcoin world.

Ways to Handle a Crypto Crash

Handling a cryptocurrency crash can be difficult, but it's still possible. It's possible to turn a crypto market crisis into an opportunity if you follow these techniques and tricks.

Avoid Quick Selling:

Stay cool is the first guideline for handling a crypto crash. During a market drop, sentiments can run high and cause rash decisions. Losses from selling during a fall are usually trapped in, making it difficult to enter the market again at the opportune moment. So, to avoid making snap decisions, take a deep breath. Recall that most cryptocurrency market collapses are followed by bounces.

Do Deep Studies:

In the cryptocurrency field, researching is your best friend. You may make good use of your time during a crash of Bitcoin by studying blockchain-based projects in-depth. Examine their long-term potential, technologies, and foundations. When it comes time to find investing opportunities after the market starts to recover, this information will be important.

Stop-Loss Orders:

Keeping stop-loss orders in place can save your life. To reduce possible losses, these are established levels when you're ready to sell an asset. You may automate some of your risk control and stay clear of stupid choices by placing stop-loss orders. Investing in protection is possible even if you're not keeping a close eye on the market.

Hold on for Dear Life:

It's common to hold on for dear life during market crashes. It includes purchasing and holding cryptocurrency long-term, even with changeable market patterns. This approach depends on the idea that some assets can perform well over the long run. You may survive the crisis and possibly profit from future development if you hang onto your capital.

Increase Portfolio Flexibility:

During a crypto market crisis, diversification is a risk control technique that can help protect your money. You lower your chances of the risk of any one asset by distributing your investments among different cryptocurrencies and other types of assets. This makes it more likely that your capital will be protected.

Bitcoin Performance in September 2024

Right now, Bitcoin is down. Cryptocurrency prices are being affected by growing international tensions as well as investor fears that a US economic downturn may be coming. From its peak in March, Bitcoin has decreased by around 24.75%.

From its peak of $73,750, the value of Bitcoin had dropped by about $50,000 in the first week of the month. As a result of the Security and Trading Commission's increasing aggression against major companies in the cryptocurrency sector, like Consensys, the markets are currently struggling with legal inquiries.

With Bitcoin now below $53,000, it's clear that the cryptocurrency industry has bigger issues. Legal demands and demographic considerations are among the negative market incidents that have contributed to this decline.

Is it Safe to Invest in Cryptocurrency?

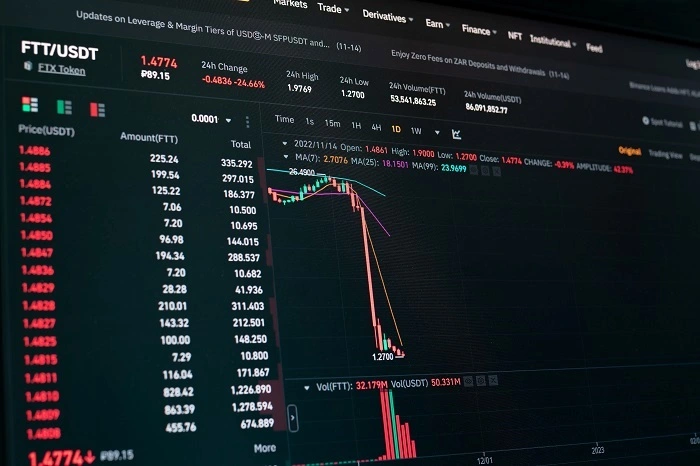

The cryptocurrency market experienced both positive and negative developments over the last few years, including the effects of the Russia-Ukraine crisis, the crash of Terra-Luna, the collapse of FTX, and tighter tax regulations.

In times like these, cryptocurrency investors think it's safe to invest in strong digital coins like Bitcoin and Ethereum. Cryptocurrency experts believe that investors should only consider investing 5% of their total portfolio in cryptocurrencies.

The most crucial thing to remember is that the market is extremely unpredictable and you could lose everything, therefore you should only invest a small portion of your life savings.

Guidelines before Investing in Cryptocurrency

The idea of investing in cryptocurrency is one that many find very attractive. When it comes to cryptocurrency, Bitcoin is an investment that you just must make, but before you do, there are a few things you should know.

- Examine the Bitcoin market's volatility, then make sensible investments.

- Consider investing in cryptocurrency as a long-term strategy.

- It makes sense and is safe to give 5% to 10% of your total portfolio to Bitcoin.

- Do deep research on the ideal times to buy and sell Bitcoin to optimize your returns.

Security Concern:

You may naturally be wondering if investing in Bitcoin is a secure option considering its price swings and instability. Unlike mutual funds or stocks, which are defined forms of investment, Bitcoin's whole value is dependent on prediction.

Getting advice from a financial expert who can help you invest in a cryptocurrency that best meets your financial objectives would be a wise decision.

Frequently Asked Questions:

Q. Will cryptocurrency recover in 2024?

With a potential jump to $100,000, Bitcoin is preparing to surpass its all-time high of $73,000. In addition to Bitcoin, four other cryptocurrencies - Pepe Unchained, Crypto All-Stars, Base Dawgz, and Solana show hope for substantial growth in 2024 because of their unique attributes and active communities.

Q. What does cryptocurrency's future hold?

By 2030, experts predict that the size of the global crypto market will have more than tripled. All of this points to one major pattern. Once known primarily to a small group of anti-authority investors, cryptocurrency is swiftly making a name for itself among the general public.

Q. Which coin crashes out the most?

Based on an examination of the Top Crypto Losers chart, Volt Inu V2, with a price of $0.000000271, has had the most fall, ranking first with a 36.87% reduction in the last day.